|

Table of Contents

Note: For technical information on Global DecisionMaker such as data dictionary, visit the Data Integration Toolkit site and view the related links on the Data &

Product Interpretation section of the Online Documentation page. If prompted to log in, use your

Global DecisionMaker ID and password.

Introduction, Section 1

What is Global DecisionMaker? |

The Global DecisionMaker application at www.dnbdecisionmaker.com is a powerful ASP (Application Service Provider) solution developed by D&B to automate your

global decisioning process. A web-based user interface provides easy access to the Rules Management System for customizing your global risk policy. A powerful

rules engine combines D&B's global data with your own customized rules to produce real-time decisions. The Data Integration Toolkit can be used to

integrate a customized Global DecisionMaker solution into your own website or risk management application.

|

Why use Global Decision-Maker? |

E-Commerce Applications: Facilitate a wealth of online transactions by integrating decisions delivered via Global DecisionMaker into all your e-commerce

applications.

Speed: Automate and accelerate credit decisions in real-time, at the point of a transaction. Pre-screen customers and approve credit quickly, pre-empting your

competitors by closing sales fast.

Reduce Cost: Reduce development costs and time to market by leveraging Global DecisionMaker, a web-based ASP application, and the XML integration

technology of the Data Integration Toolkit.

Consistency: Use Global DecisionMaker to implement a consistent and objective risk policy throughout your organization.

Empower: Empower distributed resources throughout your organization to make instant decisions based on a centrally established and managed risk policy.

Reduce Risk: D&B's predictive scores validate and assess the detailed and complex relationships between the available data to predict the likelihood of a

company suffering financial stress or paying debts in a severely delinquent manner.

Trust: Base your decisions on D&B's trusted global business information and trade with confidence, empowering you to identify and maximize opportunities

while minimizing risk.

Customer Satisfaction: Process applications quickly and efficiently to approve your customers' applications on demand, resulting in increased cash flow and

profitability.

|

How does Global DecisionMaker work? |

Simply set your own decision strategy within Global DecisionMaker by customizing the risk policy rules supplied, so that automated transactions take place only

if the decision meets your pre-determined level of risk.

Global DecisionMaker will instantly and accurately identify a business and bring together all the available information from D&B's global database of over 73

million businesses worldwide. It will then compare this against your carefully defined decision-making criteria and deliver your decisions, determining whether

applications should be accepted and on what terms.

|

Is it easy to implement? |

The Global DecisionMaker application has been designed to make it easy for you to customize and implement your global risk policy by providing generic guidelines

for each country. The predefined guidelines evolved from D&B's vast experience in customizing credit limits across a wide range of industry segments, sizes and

countries. These generic guidelines provide predetermined benchmark recommended limit matrices (decision tables), segmented by Risk Bands, Industry groups and

Sizes. Use the D&B default rules to begin making decisions immediately, or use them to help you implement an effective and competitive risk management process by

customizing or combining them with your own custom rules to meet your specific needs.

|

What are the access options? |

Once you set your decision strategy, you can use the Data Integration Toolkit to integrate your customized solution into your own website or in-house risk

management application. Alternatively, you may wish to view the output via a report, which can be delivered on the Global DecisionMaker website. Or,

increase productivity by delivering decisions directly into the hands of your teams using wireless technology. For more information about accessing Global

DecisionMaker from your wireless PDA or phone, see the Wireless Reference Guide.

However you choose to work, you will have access to other D&B reports and Data Integration products for in-depth information if further analysis is required.

|

Back to Table of Contents

Security & Access Privileges, Section 2

Overview |

This section describes all of the security options/privileges that will provide you with the ability to control who can access Global DecisionMaker and what

their level of access will be.

|

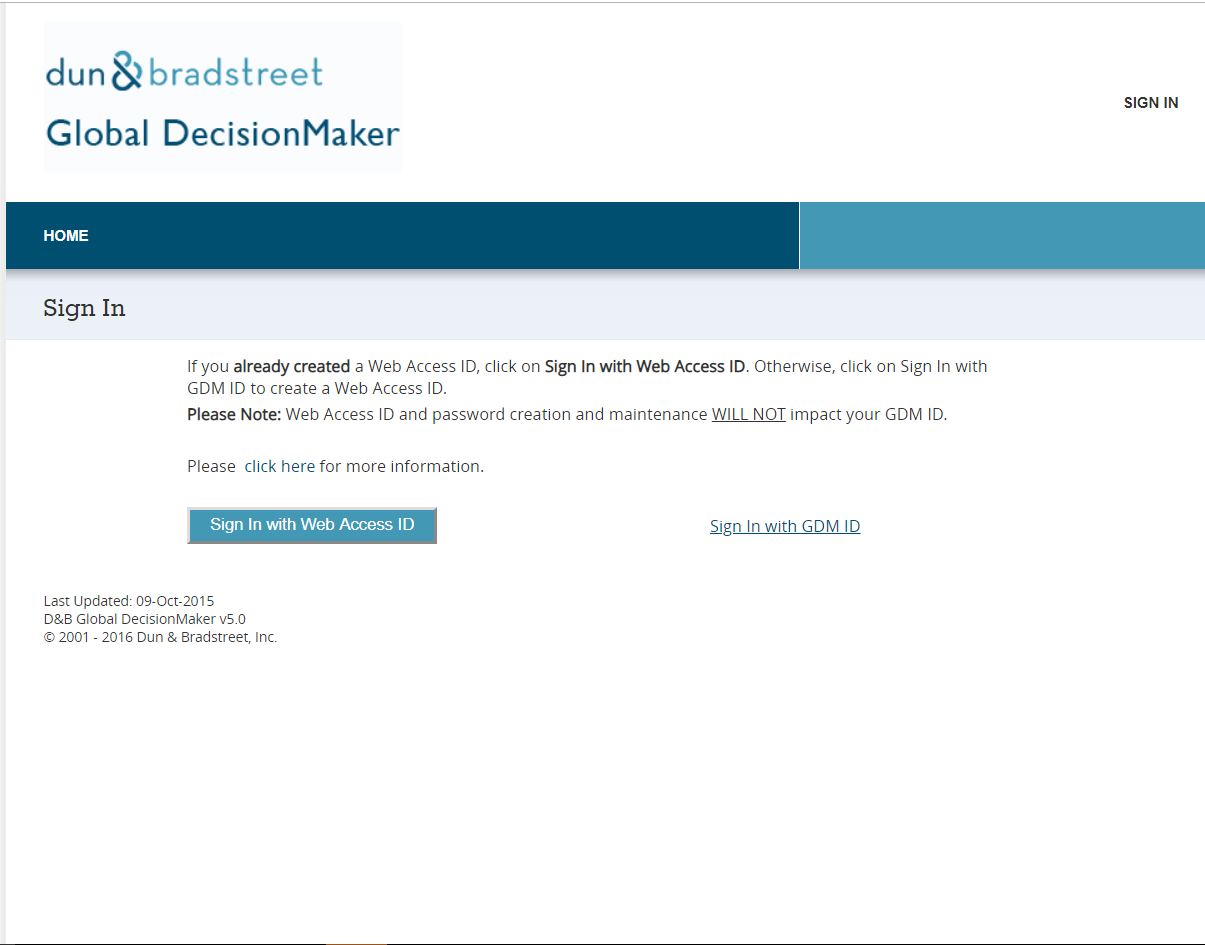

Access the Website & Application |

In order to access and use Global DecisionMaker,the following must happen:

- Receive a Data Integration Toolkit / GDM User ID

- Register a Web Access ID and password

Please follow the steps below depending on the category you fall into.

If you do not have a Web Access ID:

- Navigate to Global DecisionMaker

- Click "Sign In with Tookit User ID" and enter your Toolkit/GDM user ID

- Upon successful login, specify your Web Access Id and Password and click "Submit"

- Enter your First Name, Last Name, Country, Language and click "Submit"

- After successful registration, sign in using your new Web Access ID

If you already have a Web Access ID:

- Navigate to Global DecisionMaker

- Click "Sign with Web Access ID" and enter your Web Access Id and password

Once you successfully log in, you can begin making decisions with the Global DecisionMaker application.

NOTE - If you do not have a valid Toolkit/GDM User ID and Password, contact your local D&B representative. For all other inquiries, follow the Customer Support procedures on the Data Integration

Toolkit website at http://toolkit.dnb.com.

|

Password Standards |

D&B values your security and privacy and for that reason, your Global DecisionMaker has been enhanced with the following standards:

- Passwords must be:

- Password rules are as follows:

|

|

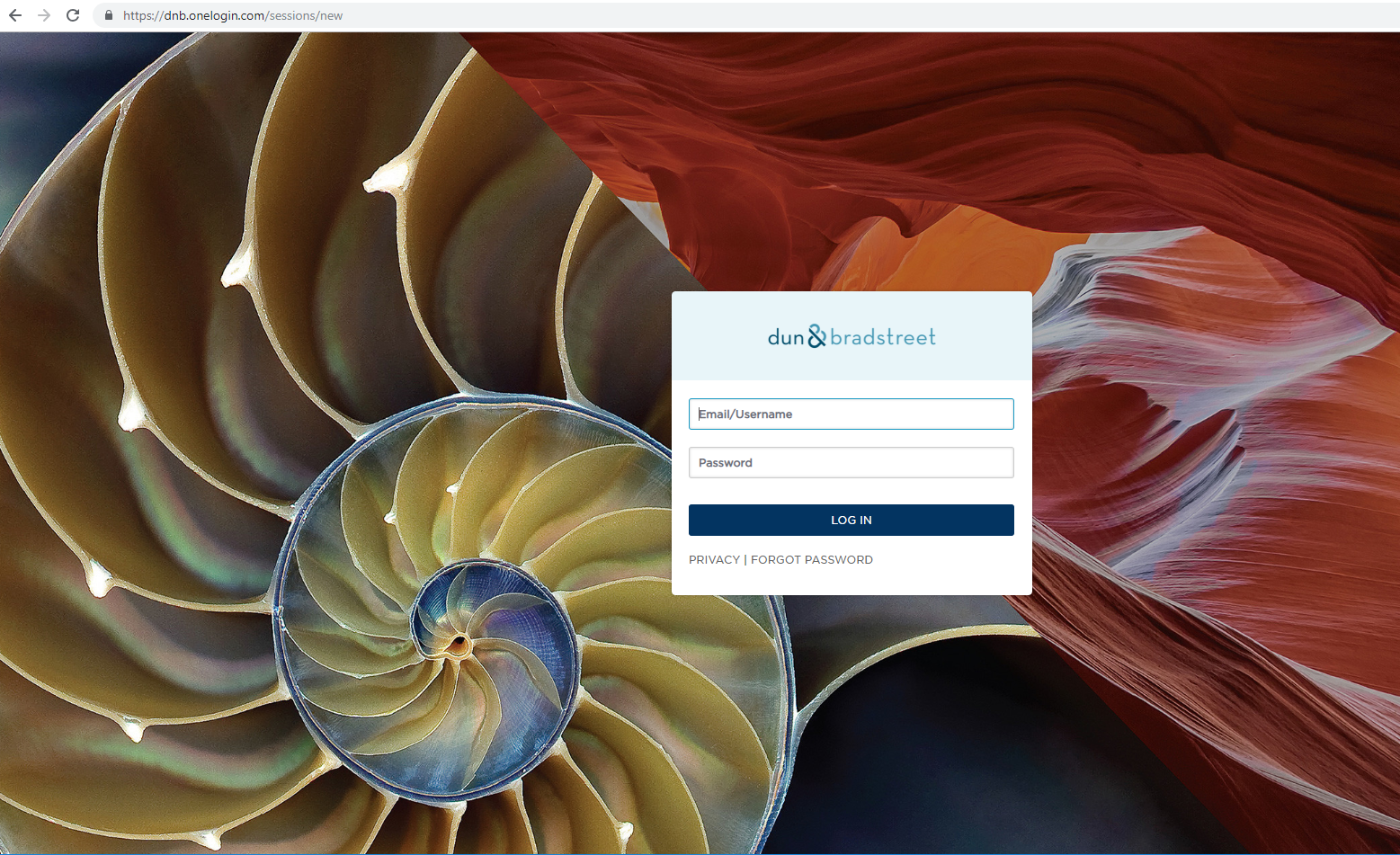

Login with Web Access ID

Forgot Password / Locked Out

Change Profile / Password

|

Web Access ID users can click "Sign with Web Access ID" to to access Global DecisionMaker. Upon login, D&B validates your permission and will grant access accordingly.

Forgotten Password

If you have forgotten your password, click "Sign with Web Access ID" and click "FORGOT PASSWORD" to start the password reset process. You will receive an email with instructions on how to reset the password.

Locked Out

If you have attempted to sign in more than 9 times, your Web Access ID will be locked out. You can attempt to log in again after 30 minutes.

Change Password

To change your Web Access ID or password,simply log into Global DecisionMaker with your current Web Access ID. Then click "Modify Profile/Change Password" on the top navigation bar and modify your profile/password accordingly.

If you attempt to sign in with an expired password, you will be instructed to click the Change Password link to enter a new password. Please note that you cannot use the same password as your prior 5 passwords.

|

Data Products |

In order to generate a decision from the Global DecisionMaker application, a User must be granted permission to order Global DecisionMaker data products.

There are three data product options available from the Global DecisionMaker application:

Global DecisionMaker (available to existing customers only) – A report utilizing commercial information that provides a quick decision and basic

information. Global DecisionMaker Plus – A report utilizing commercial information that provides a quick decision plus the detailed data driving the decision. -

GDM Small Business – A report that provides a quick decision utilizing both commercial and consumer data, basic commercial

information, up to 125 consumer data elements per principal used to make the decision and the full consumer text report. Risk class, percentile and commentary are

also provided.

Permission must be granted for each of these additional products in order to access them via Global DecisionMaker:

- Business Verification

- Vendor Management

- Quick Check

- Business Information Report

This provides management the ability to pre-define the data products that can be ordered by each User.

|

Rules Management |

Global DecisionMaker’s Rules Management System enables you to implement your risk policies, and grant permission to other Users

within your business who may also create, edit, view, and update existing rules.

|

Make Decisions |

In order to make decisions, a User must be granted permission to Make Decisions.

|

|

Create

New

Rules/Edit Rules

|

In order to access the Rules Management system and create new rules, a User must be granted permission to Create/Edit Rules.

In order to access the Rules Management system and edit existing custom rules, a User must be granted two levels of permission:

Data Integration User ID privilege to Create/Edit Rules If they did not create the rule, Global DecisionMaker application permission to edit the rule by the Rules Creator.

|

|

View

Rules

|

The Rules Management system provides you with the ability to grant permission within your organization to those associates that will need to review the rules behind a

decision, but are not authorized to change them. Additionally, a User with View Rules permission will be able to view all transactions made using the rule byy all

users.

In order to access the Rules Management system and view a rule, a User must be granted two levels of permission:

Data Integration User ID privilege to View Rules Global DecisionMaker application permission to View Rules by the Rules Creator

|

|

Review and Update

Decisions

|

Global DecisionMaker’s Data Mart provides you with the additional capability of reviewing, updating and exporting prior decisions and Global

DecisionMaker data products.

In order to access the Data Mart, a User must be granted two levels of permission:

Data Integration User ID privilege to View History/Update Decisions Global DecisionMaker application permission to Update/Review History by the Rules Creator

For D&B’s default rules, Users can only view and update their own decisions. If a manager wishes to view decisions for a group of Users that will be using a

D&B default rule, they must save the D&B Default Rule with a new name under their ID and grant User permissions.

|

Country Availability |

In order to manage access to country information from the application, a User can be granted access permission in Data Integration Toolkit for specific

countries. This provides a management option to pre-define the countries from which decisions can be ordered for each User.

|

GDM Small Business Availability |

GDM Small Business functionality is granted in Data Integration Toolkit. In order to Make Decisions using GDM Small Business, the GDM Small Business product must

be turned on for Users in their User ID profile.

|

Testing Toolkit Implementation |

It is very important to understand that when implementing Global DecisionMaker with the Data Integration Toolkit, Test IDs should only be used to test the

implementation of the Toolkit. Do not use a Toolkit Test ID for implementing rules within Global DecisionMaker. If a Test ID is used to implement a rule set, the

rules will be lost when the Test ID expires.

In order to test the implementation of a Toolkit, a User must be granted a Test ID by Data Integration Toolkit administration and follow the standard Toolkit test

procedures.

Global DecisionMaker has a test harness for testing rule sets. Your production User ID should be used for this testing.

|

Back to Table of Contents

Global DecisionMaker Website, Section 3

Making Decisions, 3.1

Overview |

The Global DecisionMaker website is a user-friendly option for making decisions via the Global DecisionMaker application.

|

Global DecisionMaker Data Products |

There are three data decisioning product options available from the Global DecisionMaker website:

Global DecisionMaker – A report utilizing commercial information only that provides a quick decision and basic information. Global DecisionMaker Plus – A report utilizing commercial information only that provides a quick decision plus the detailed data driving the

decision. GDM Small Business – A report that provides a quick decision utilizing both commercial and consumer data, basic commercial information, up to 125

consumer data elements per principal used to make the decision and the full consumer text report. Risk class, percentile and commentary are also provided.

The Global DecisionMaker and Global DecisionMaker Plus data products are only available in the countries where D&B generic Risk Bands have been

defined. GDM Small Business is only available in the U.S. for decisions on U.S. businesses.

Note: To learn about the details behind D&B’s Predictive Scores and Generic Credit Limits, please refer to Sections 10 and 11.

|

| Risk Bands Defined |

Generic risk bands have been created for the following countries. |

| Andorra |

Finland |

Monaco |

Sweden |

| Australia |

France |

Netherlands |

United Kingdom |

| Austria |

Germany |

New Zealand |

United States |

| Belgium |

Ireland |

Norway |

Venezuela |

| Canada |

Italy |

Portugal |

|

| Columbia |

Japan |

San Marino |

|

| Denmark |

Luxembourg |

Spain |

|

|

Additional

Products available via GDM

|

The Global DecisionMaker website also provides access to these additional data products in all countries where they are available from the Data Integration

Toolkit:

- Business Verification

- Vendor Management

- Quick Check

- Business Information Report

|

Getting Started |

In order to access the Global DecisionMaker website, a User must be granted a User ID and access permission. All Users must log in with their User ID &

Password. Once a User ID & Password have been successfully validated for Global DecisionMaker permission, access to the website is granted.

If your User ID is GDM Small Business enabled, a pop up screen will appear at the start of each session containing a Permissible Purpose agreement. This

agreement governs the uses of consumer data. Click the "I Agree" button to confirm acceptance of the terms as outlined in the Permissible Purpose agreement and proceed

into the application. If you do not wish to accept the terms of the agreement, click the "I Disagree" button. You will still proceed into the Global DecisionMaker

application but will be unable to conduct Small Business transactions.

Note: If you find yourself logged into someone else's ID, that User probably used Global DecisionMaker on the same computer and did not log out at the end of

their session. Just select the "Sign In" link from the menu on the left side of the website, and then log yourself in using your ID and password.

If several people are using Global DecisionMaker on the same computer, we strongly recommend selecting the "Sign Out" link at the end of each session. This

protects the privacy of each User and integrity of the Decision Data Mart.

|

Make Decision |

Follow the steps below to make a Decision:

|

|

Step

|

Action

|

|

1

|

Once you have successfully logged onto the Global DecisionMaker website, you can begin the decision making process by selecting the "Company Search" navigation

button that brings you to the Company Search screen. There are three options available to you for looking up the company you wish to inquire upon:

- Company Name

- DUNS Number

- Phone Number

Select the option for entering your company search criteria by selecting the appropriate tab.

|

|

2

|

If the selection is "Company Information" the User is required to input:

- Company Name

- State/Providence/Region

Optional fields are:

- Address

- City/Town

- ZIP/Postal Code

If the selection is "D-U-N-S® Number", the User is required to input a valid 9 digit D-U-N-S® Number.

If the selection is "Phone Number", the User is required to input the "Country" and a valid "Telephone Number".

|

|

3

|

Enter your name or endorsement in the "Your Billing Reference" field in the upper right hand corner of the screen. This billing reference will appear as the endorsement

on your D&B Usage Statement.

For Market Place transactions in which Global DecisionMaker is not being used for inquiries, the User ID will appear on the usage statement.

Note: Only alphanumeric characters, A-Z or 0-9, can be entered in this field. Do not use spaces or punctuation.

|

|

4

|

After entering the appropriate search criteria click "Submit."

|

|

5

|

Global DecisionMaker performs a search of D&B’s global database and returns a list of potential company matches for the User to select from on the

Search Results screen.

Also a Fraud Risk Score is returned for the input search criteria. The Fraud Risk Score, available in US only, is a powerful, predictive score that is designed to help

credit issuers easily assess the potential fraud risk of a new business credit applicant.

The Fraud Risk Score leverages the Global Data Collection, Entity Matching, and Predictive Indicator Drivers of D&B's Quality Assurance Process,

DUNSRight™.

Once activated, the Fraud Risk Score will automatically be generated through the input of applicant company Name and Address data. It will be calculated

real-time based on several sources of newly identified predictive data. A number of these sources, as well as the predictive algorithms and model, are proprietary to

D&B.

The Fraud Risk Score will be delivered as a separate packet and will require system enhancements prior to implementation.

From the Search Results screen, the User can:

Select one of the companies returned by clicking on it. This will take you to the Available Products screen. Select the product you wish to order by clicking

on it. This will take you to the Make Decision screen, where you will enter your transaction information. Bypass the Available Products screen and proceed directly to the Make Decision screen by clicking the product link to the right or your company

selection. Order a consumer only Small Business Risk Account Score by clicking on "Principal Information Only". This will take you to the Principal Information

screen. - Return to the Search screen to modify the search criteria by clicking the "Back" button on your browser.

|

|

6

|

From either the Search Results screen or the Available Products screen, select a Global DecisionMaker data product:

- "Global DecisionMaker"

- "Global DecisionMaker Plus"

- "Small Business Risk Account Score"

|

|

7

|

If you click on "Global DecisionMaker" or "Global DecisionMaker Plus" you will go directly to the Transaction Information screen.

If you click on "Small Business Risk Account Score", you will go to the Principal Information screen, an additional input screen where you will add information

on the business’ principals. Required fields are:

- First Name

- Last Name

- Street Address (home)

- State (home)

- Zip code (home)

- Social Security Number

You can inquire on up to two principals per business.

|

|

8

|

You can enter information on one or two Principals by clicking on the appropriate tabs. After entering Principal Information, click on the "Proceed to Product Order"

button. This will take you to the Transaction Information screen.

|

|

Ordering a Commercial Only Small Business Risk Account Score

|

You can order a commercial only Small Business Risk Account Score by clicking on "Skip Entering Principal Information, and Proceed to Product Order". No consumer data

will be used in the decision.

Note: If you do not add any principal information and click on the "Proceed to Product Order" button at the bottom of the screen, you will get an error message

prompting you to fill in missing information.

|

|

Make Decision Input Screen

|

Once you have selected the data product and entered Principal Information if ordering the Small Business Risk Account Score, the Transaction Information screen

appears. It is important to note that all currency must be entered as Internationalized Numeric whole values without spaces, punctuation, symbols, or special

characters.

Note: If ordering the Small Business Risk Account Score, you must enter USD for U.S. Dollars.

Enter the Transaction Information for the Decision as follows:

|

|

Step

|

Action

|

|

1

|

Select the Risk Policy Rule to apply to the decision in the "Risk Policy Rule" field. You have two options:

- Select nothing and use the default rule previously defined

- Select a different "Risk Policy Rule" from the drop-down list

Note: If any component of a rule has been updated to a new version, the system will not automatically select the newest version for a previously defined composite risk

policy. You must explicitly state which version to use in a new composite rule and designate it as the default if necessary.

|

|

2

|

Enter the Transaction ID you want attached to the decision in the "Transaction ID" field. You have two options:

- Enter your own Transaction ID, up to 16 characters, to be used as an identification code for your decision. This will appear on the report.

- Enter nothing, it will be populated with a D&B generated Transaction ID.

|

|

3

|

Enter currency in the "Currency field" by selecting a currency type from the drop-down menu.

Note: Currency should match the recommended limit currency in the composite rule.

|

|

4

|

In the "Requested Amount" field, you have two options:

- Enter the amount of the transaction to be approved.

- Enter nothing and the decision will be based on the limit defined in your decision rules.

Note: In the application the ‘Requested Amount’ is compared to the 'Recommended Limit' and translated to a 'Decision' that is reflected in an 'Action'. For

example, if the ‘Requested Amount’ is greater than the ‘Recommended Limit’ that has been defined for the Risk Band, the outcome may be a "Pending"

decision that has an action "Refer to Corporate Credit Manager".

|

|

5

|

In the "Outstanding Balance" field, you have two options:

- Enter the outstanding amount previously approved for this company, and it will be factored into the decision.

- Enter nothing and the decision will be based just on the "Requested Amount".

|

|

6

|

Enter "Custom Defined Input" Fields, if necessary.

|

|

7

|

Click "Make Decision".

Note: If you select a Branch, the decisions will always be made at the Headquarter level. Global DecisionMaker will always trade up to the Headquarters for

decisioning.

|

|

8

|

The Global DecisionMaker decisioning engine will process your inquiry and deliver a decision based upon your rules, D&B's Global information, consumer

information (for Small Business Risk Account Score), and the transaction information you entered. Following is a Global DecisionMaker report with a decision to

"Reject" due to a High Risk band.

|

|

9

|

When the decision is returned there are four options:

- Order additional products on the same company for further analysis by clicking on the "Additional Products Available" link. This will return the User to the

Available Products screen.

- If the User has "Update Decisions" permission, they can update the decision by clicking on the "Update Decision" link.

- Print the report by clicking on the "Printer Friendly Report" link. When the printer friendly report displays on a pop up screen, select "Print" from the "File" drop

down menu and change the page orientation to landscape.

- Process a new decision by clicking on "Company Search" on the navigation bar.

|

Review Decisions, 3.2

|

Overview

|

Global DecisionMaker captures every GDM decisioning transaction and stores them in a Data Mart for 120 days. This provides the additional capability of

reviewing, managing, and updating prior decisions.

This powerful tool enables a User to:

- View all prior decisions

- Update decisions previously made

- Analyze the effectiveness of your Risk Policy

- Download prior decisions for further analysis

|

|

Getting Started

|

In order to access the Data Mart a User must be granted permission. The User ID must have Update Decisions/View History privilege set within the Global

DecisionMaker application.

Access the Data Mart by following the steps below:

|

|

Step

|

Action

|

|

1

|

Once you have successfully logged onto the Global DecisionMaker website, start by selecting "Review Decisions" on the navigation bar. This brings you to

the Review Decisions screen, where there are two options:

- "Review All Decisions" within a selected date range

- "Review Pending Decisions" within a selected date range

|

|

2

|

Enter the date range to be reviewed.

|

|

3

|

Up to 25 records will be displayed on your screen. To view additional transactions, go to the bottom of the spreadsheet and click on the "Next" button to view the next

group of transactions. Click on the "Previous" button to view the previous screen.

|

|

4

|

Once you are in the Data Mart you have additional options:

|

|

Option

|

Description

|

|

Change Search Date

|

Click on "Change Search Date". This brings you back to the Review Decisions screen where you can change the date range.

|

|

Sort By

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sort Order

|

Sort decisions in "Descending" or "Ascending" order.

|

|

Review Details

|

Review details of the decision by clicking on "Review Details". This will bring up the original GDM data product used to make the decision.

|

|

Download

|

- Download the entire history selection into a spreadsheet by clicking on either "Download Small Business Data" or "Download GDM Data".

If you download Small Business Data, all consumer bureau information, D&B data and scoring aggregate is exported.

If you download GDM Data, only D&B’s commercial information contained in the GDM or GDM Plus reports is exported.

|

Update Decisions, 3.3

|

Overview

|

In addition to reviewing decisions previously made, Global DecisionMaker provides you with the ability to update all decisions previously made. This is a

valuable feature for Pending decisions, which upon review can be rejected or approved to complete your decision process.

|

|

Getting Started

|

In order to update decisions, a User must be granted two permissions:

- User ID privilege to Update Decisions/View History.

- Permission to Update/Review Decisions for the specific Risk Policy Rule, which is granted by the creator of the rule.

Update decisions by following the steps below:

|

|

Step

|

Action

|

|

1

|

Once you have successfully logged onto the Global DecisionMaker website, Start by selecting "Review Decisions" on the navigation bar. This brings you to the

Review Decisions screen. There are two options:

- "Review All Decisions" within a selected date range

- "Review Pending Decisions" within a selected date range

|

|

2

|

Enter the date range to be reviewed.

|

|

3

|

By selecting "Review Pending Decisions", only the Pending decisions for the time range appears in the Data Mart.

|

|

4

|

Click on "Review Details" in the Decision Status column on the row of the case to be reviewed for updating. The Review Details screen will appear.

|

|

5

|

At this time the User can click on "Additional Products Available" to order and review additional information.

|

|

6

|

To update the decision, click on "Update Decision".

|

|

7

|

Update the Decision by checking "Accept" or "Reject".

|

|

8

|

Enter any comments to appear on the updated decision in the input box.

|

|

9

|

Enter the approved amount (numbers only).

|

|

10

|

Click on "Set" and the new decision will be updated, or select "Cancel" and no changes to the decision will be made.

|

|

11

|

Click on the "Return to Review Decisions" link to return to the Data Mart.

|

Back to Table of Contents

Manage Risk Policy, Section 4

Rules Management System Overview, 4.1

|

Overview

|

Global DecisionMaker contains a user-friendly rules management wizard to help you implement your risk policy into the application. You can use the pre-defined

default rules built into the application, create your own rules, or combine the two.

Within the Rules Management system you can:

- Select the countries to which your rules will apply

- Set the criteria for exception handling

- Define your tolerance for risk by establishing risk classes using D&B's predictive scores

- Set credit limits for application processing

- Provide decision and action messages to drive decisions into actions

- Determine who within your organization has access to which rules

Furthermore, you have dynamic access to your risk policy so you can update it at any time.

|

|

Compo-nents

|

The Rules Manager consists of the following components:

- High Level Exceptions

- Manage Risk Bands

- Manage Recommended Limits, Decisions & Actions

- Special Handling Rules

- Custom Input Data

- Risk Policy Rule Grouping & Administration

- Test Rules

|

|

Creating and Editing Rules

|

In order to access the Rules Management system, a User must have permission to create and edit rules. This allows you to:

- Create your own rules, or combine them with the pre-defined default rules

- Grant permission to Users to use rules

- Set criteria for exception handling

- Define tolerance for risk by creating risk bands

- Define credit Limits, Decisions and Actions

- Grant access privileges to your rules to other Users in your business

|

High Level Exceptions, 4.2

|

Overview

|

In High Level Exceptions, you have the ability to define and prioritize criteria for exception processing. Exception processing automatically assigns a Reject or

Pending decision to new applications, regardless of additional information or factors that would normally be considered. High Level Exceptions are over-ride rules that

take precedence over your risk policy.

|

|

D&B's Default

High Level Exceptions

|

The High Level Exception default rules and priorities established by D&B for each country are based on historical business trends and predictive scores. D&B

does not define any consumer based High Level Exception rules in the Default rule group. The default rules established by D&B are listed below and apply to GDM and GDM

Plus data products only. They will automatically return a Reject or Pending decision if any of the following criteria are met:

|

|

Priority

|

Decision

|

Rule

|

Definition

|

|

1

|

Reject

|

All Countries

Out of Business

|

Our information indicates this business is no longer active at this location.

|

|

2

|

Reject

|

All Countries

Financial Embarrassment

|

Currently there is record of open bankruptcy, receivership, liquidation, discontinuance with unpaid obligations, or equivalent in D&B's files.

|

|

3

|

Reject

|

Australia

Dynamic Risk

Score Override

|

The subject is in financial distress: external administrator or receiver manager appointed, in liquidation, scheme of arrangement, out of business, mortgagee in

possession, criminal investigation.

|

|

4

|

Reject

|

Australia

Zero Dynamic Delinquency

|

The subject is in Liquidation, or Out of Business.

|

|

5

|

Reject

|

US

Zero Delinquency Score

|

This business has been designated as Discontinued at this Location, in Open Bankruptcy, or Higher Risk.

|

|

6

|

Reject

|

New Zealand

Zero Delinquency Score

|

The subject is in Under External Administration or Out of Business.

|

|

7

|

Reject

|

Australia

Zero Dynamic

Risk Score

|

The subject is in Financial Distress.

|

|

8

|

Reject

|

US

Zero Failure

Risk Score

|

This business has been designated as Discontinued at this Location, in Open Bankruptcy, or Higher Risk.

|

|

9

|

Reject

|

Europe

Severe Negative Information

|

Our information indicates severe negative information about this business.

|

|

10

|

Pending

|

Europe

(Except UK, IE)

New Business

|

D&B has identified this as a new business. Refer for further analysis.

|

|

11

|

Pending

|

Germany

New Business

|

D&B has identified this as a new business. Refer for further analysis. D&B credit recommendation:

[MAX_CR_CRCY_CD] [MAX_CR]

|

|

12

|

Reject

|

UK

Special Information

|

D&B has identified special information about this business and does not recommend credit.

|

|

13

|

Reject

|

UK, IE (Ireland)

Miscellaneous Override Code

|

D&B has identified special information about this business and does not recommend credit.

|

|

14

|

Pending

|

UK, Ireland

New Business

|

D&B has identified this as a new business. Refer for further analysis.

|

|

15

|

Pending

|

Europe

Minimal Data

|

Limited information is available for this company. Refer for further analysis.

|

|

16

|

Pending

|

Europe (Except GB, IE, DE) Not Recommended Lines of Business

|

D&B does not recommend automated decisions for organizations in certain lines of business (banks, building societies, financial institutions, insurance

services).

|

|

17

|

Pending

|

Germany Not Recommended Lines of Business

|

D&B does not recommend automated decisions for organizations in certain lines of business (holdings, investment companies).

|

|

18

|

Pending

|

Europe

Foreign Company

|

D&B has identified this as a foreign registered company. An automated decision is not recommended for business with this legal form.

|

|

19

|

Reject

|

Europe

(Except UK, IE)

Miscellaneous Override Code

|

D&B has identified special information about this business and does not recommend credit.

|

|

20

|

Pending

|

Germany

Miscellaneous Override Code

|

D&B has identified special information about this business. Refer for further information. [CURRENCY] [MAX_CR]

|

|

21

|

Pending

|

Nordic

Insufficient Information

|

D&B does not have sufficient information to provide a decision on this business.

|

|

22

|

Pending

|

Nordic

Further Review

|

Please refer for further review. The D&B Rating is [DNB_RTG].

|

|

23

|

Pending

|

Spain

Negative

Net Worth

|

Negative net worth. Refer for further analysis.

|

|

24

|

Reject

|

Italy

Risk Indicator = 4

|

The D&B Risk Indicator indicates a high level of risk. Do not extend credit.

|

|

25

|

Pending

|

Austrian - Weak Balance Sheet

|

D&B has identified an overall weak condition of the balance Sheet. Refer for further analysis.

|

|

26

|

Pending

|

Austrian - Weak Parent Company

|

D&B has identified that the parent company is in a financially weak condition. Please refer for further analysis.

|

|

27

|

Pending

|

Austrian - Poor Trend and Sector

|

The Risk indicator was mainly affected by the falling trend and high risk of the business sector. Please refer for further analysis.

|

|

28

|

Pending

|

Failure Risk Score = Null

|

D&B has no Failure Risk Score for this company. Please order a business information report for more information or contact your local customer services.

|

|

D&B's Optional Exception Rules

|

Optional High Level Exception rules are provided to give you additional rules with which to customize your Risk Policy. These rules were established by D&B

based on historical business trends and predictive scores, and are housed in "Choose From List".

Note: Since D&B does not define default rules for the Small Business data product, the above global D&B Default High Level Exception rules will appear in the

Choose From List as Optional High Level Exception rules, along with the Optional High Level Exception rules listed below:

|

|

Decision

|

Rule

|

Definition

|

|

Pending

|

Presence of Suits or Judgments

|

Our information indicates this company has a presence of suits and/or judgments.

|

|

Pending

|

Age < 4

|

Our information indicates this company has been in business less than four years.

|

|

Pending

|

Age < 3

|

Our information indicates this company has been in business less than three years.

|

|

Pending

|

Age < 2

|

Our information indicates this company has been in business less than two years.

|

|

Pending

|

Age < 1

|

Our information indicates this company has been in business less than one year.

|

|

Pending

|

Negative Net Worth

|

Our information indicates this company has negative net worth.

|

|

Getting Started

|

To define a new or edit an existing High Level Exception rule group, follow the steps below:

|

|

Step

|

Action

|

|

1

|

Click on "Manage Risk Policy" on the navigation bar on the left side of your screen. This will bring you to the Manage Risk Policy screen.

|

|

2

|

Click on "High Level Exceptions". This will bring you to the Manage Risk Policy: High Level Exceptions screen, where you have three options:

- "Edit" - Edit an existing High Level Exception rule group

- "Create New" - Create a new High Level Exception rule group

- "View Printable" - View all existing rule group s in a printer friendly format

|

|

Edit

|

To edit an existing High Level Exception rule group, highlight the group and click the "Edit" button. This will bring you to the High Level Exceptions Rule Group that

you want to edit, where all the individual rules that comprise that rule group are displayed. You can edit, delete or add new rules to the rule group. Follow the same

instructions below for creating a new group, starting with "Options".

|

|

Create New

|

To create a new High Level Exception rule group, click the "Create New" button. This will bring up the Manage Risk Policy: High Level Exceptions

screen where multiple rules will be displayed. These rules will be invoked unless you opt not to include them in your new group.

For GDM and GDM Plus, the list of rules that displays consists of D&B’s Default High Level Exceptions listed above.

For GDM Small Business, the list of rules that displays is as follows:

|

|

Decision

|

Rule

|

Definition

|

|

Reject

|

Out of Business

|

Our information indicates this business is no longer active at this location. Do not extend credit. For further information please order a Business Information Report.

If you have reason to believe this business is currently operating, please contact our D&B Support Team via https://service.dnb.com/.

|

|

Reject

|

Financial Embarrassment

|

Currently, there is record of open bankruptcy, receivership, liquidation, discontinuance with unpaid obligations or equivalent in D&B files.

|

|

Reject

|

US - Zero Delinquency Score

|

This business has been designated as "Discontinued at this location", in "Open Bankruptcy" or "Higher Risk".

|

|

Reject

|

US - Zero Failure Risk Score

|

This business has been designated as "Discontinued at this location", in "Open Bankruptcy" or "Higher Risk".

|

|

Reject

|

Zero Small Business Risk Account Risk Score

|

This business has been designated as "Discontinued at this location", in "Open Bankruptcy" or "Higher Risk".

|

|

Reject

|

Business Deterioration – Small Business

|

Information received within the past 90 days indicates conditions may exist which could significantly impact future operation of the company, therefore a Small Business

Risk Account Score could not be calculated.

|

|

Reject

|

Business Deterioration – Delinquency

|

Information received within the past 90 days indicates conditions may exist which could significantly impact future operation of the company, therefore a Commercial

Credit Score could not be calculated.

|

|

Reject

|

Business Deterioration – Failure

|

Information received within the past 365 days indicates conditions may exist which could significantly impact future operation of the company, therefore a Financial

Stress Score could not be calculated.

|

|

Pending

|

Contact Subscriber on Credit Bureau

|

Please specify an action step based on your small business policy.

|

|

Pending

|

File Variation on Credit Bureau

|

Please specify an action step based on your small business policy.

|

|

Pending

|

Lost or Stolen Card on Credit Bureau

|

Please specify an action step based on your small business policy.

|

|

Pending

|

Disputed Account on Credit Bureau

|

Please specify an action step based on your small business policy.

|

|

Pending

|

SSN/SIN Variation on Credit Bureau

|

Please specify an action step based on your small business policy.

|

|

Pending

|

Abnormal Report Indicator

|

Please specify an action step based on your small business policy.

|

|

Pending

|

Bureau Not Found

|

Please specify an action step based on your small business policy.

|

|

Pending

|

Months Since Most Recent Delinquency

|

Please specify an action step based on your small business policy.

|

|

Pending

|

Total Revolving/Open Balances

|

Please specify an action step based on your small business policy.

|

|

Pending

|

Total Outstanding Installment Loan Balances

|

Please specify an action step based on your small business policy.

|

|

Pending

|

Online Credit Bureau Score 1

|

Please specify an action step based on your small business policy.

|

|

Options

|

From this screen you have the following options:

|

|

Option

|

Description

|

|

Add

New Exception

|

Clicking on the "Add New" button brings up the criteria builder to create a new High Level Exception rule.

|

|

Choose From List

|

Clicking on the "Choose From" button brings up a list of all of the D&B High Level Exception rules – both rules used in D&B’s Default Rule group as

well as Optional rules that are not part of D&B’s Default Rule Group but can be used to create a new rule group. The rules that are already in the rule

group being edited/viewed will not be displayed in the Choose From list.

|

|

Priority

|

By clicking on the drop down menu in the Priority column you can change the priority setting. The High Level Exceptions will re-sort according to the priority order you

select.

|

|

Remove

|

By clicking on the "Remove" link to the right of the rule, you will remove it from the rule group.

|

|

Edit

|

By clicking on the "Edit" link to the right of the rule, you will bring up the criteria builder populated with the conditions of the rule, which you can then edit.

|

|

Choose From List

|

By clicking on the "Choose From List" button, the list of D&B’s Optional Exception Rules will appear. You can select an Optional Exception to be added to a

rule group by clicking on the "Description" link. All Optional Exceptions that are currently in the rule group of exceptions that you are editing/viewing will not be

displayed in the Choose From List.

|

|

Add New Exception

|

By clicking on the "Add New" button, the High Level Exception criteria builder will appear and you will be able to define your own Exception rule. Follow the steps

below to create a new High Level Exception rule.

|

|

Step

|

Action

|

|

1

|

In the "Description" field, provide a descriptive name for the new High Level Exception rule. Do not use any punctuation.

|

|

2

|

Select the first "Data" field that you want to use in your rule from the drop down list.

Note: Commercial data elements are listed first, Consumer elements are listed second, and User-defined custom input data elements are listed third.

|

|

3

|

Select the "Condition" that you want to use in your rule from the drop down list, e.g., =, >, <, etc.

|

|

4

|

Enter a "Value" for your condition. If using the value of "Null" the operator should be set to "Is".

|

|

5

|

Click the "Add to Condition" button to add your selections to the Condition Box. Repeat process to add new fields.

|

|

6

|

Use the "And Or ( )" buttons to the right to further define your condition statement if necessary, or type them in the box.

- Be sure to use the ( ) to surround logical operations that should be grouped together to ensure correct processing order.

- If you choose to "Add to Condition" and would like to use the Or operator, be sure to remove the And operator.

|

|

7

|

Select a "Decision" from the drop down list.

|

|

8

|

Type in the "Action Message" or click the "Select From List" button to drop down a list of predefined actions to select from.

Note:

- If a variable is used in the Action message, the field content must be enclosed in brackets. i.e., Approve up to [CR_LMT]

- The case of the field content must mirror the case used in the Customer Input Fields. i.e., ALL CAPS or all lower case.

- D&B variables are always in upper case. i.e., [REQ_CR_AMT]

|

|

9

|

By clicking "Save", the new rule will be added to the list of High Level Exceptions as priority one.

|

|

Note

|

When creating new rules it is important to consider the impact they will have. For example: If a rule for Negative Net Worth is written as (NET_WORTH < 0)

this will also include those cases for which a value for Net Worth is not available. Therefore, a better way to create it is (NET_WORTH < 0) Or (NET_WORTH is

NULL).

|

|

Priority

|

All new High Level Exceptions added to the rule group will appear as priority one at the top of the rule group. To change the priority of an Exception Rule within

the group, select a new priority from the Priority drop down box to the left of the rule. All other Exception rules will adjust accordingly.

|

|

Remove

|

To remove a High Level Exception rule from the rule group, click on the "Remove" link to the right of the rule. If it is a D&B rule it will be saved in the

Choose From List.

|

|

Edit

|

Once you have created a new High Level Exception rule, you will be able to edit it by clicking on the "Edit" link to the right of the rule. This will bring up the

criteria builder for you to modify the rule. You cannot edit D&B High Level Exception rules.

|

Manage Risk Bands, 4.3

|

Overview

|

The Manage Risk Bands option is used to establish bands, or classes, of risk based on a User's tolerance for risk.

When evaluating businesses utilizing the Global DecisionMaker and Global DecisionMaker Plus data products, the scores used and the number of Risk Bands available vary

by country, depending on which scores are available and which are the most predictive in a particular country. Risk Bands are determined by the location of the

company being reviewed, i.e. if you’re evaluating a company in the U.S., the U.S. Risk Bands will be used to make the risk assessment and credit

recommendation. You can adjust for risk tolerance by changing the default ranges for each Risk Band, and define Risk Band Overrides when specific conditions are

met. These new customized bands can be saved as a new risk band rule. The Risk Bands for D&B's Generic Recommended Limit Guidelines are set at five levels: High,

High to Moderate, Moderate, Low to Moderate and Low. You can define as little as two, or up to the maximum number of Risk Bands available for a particular

country.

When evaluating small businesses utilizing the Small Business Risk Account Score data product, risk assessments can only be performed on U.S. businesses, as the U.S. is

the only country in which this score is available. D&B does not define default rules utilizing the Small Business Risk Account Score due to the use of consumer data in

the score. Once Users define their own small business rules, they can then save them as default, adjust them to align with your risk tolerance, and define Risk Band

Overrides when specific conditions are met.

For more information on measurements of risk, see "A Word About Predictive Scores".

|

|

Generic

Risk Band Availability – GDM and GDM Plus

|

GDM has been designed to make it easy for you to customize and implement your Global Risk Policy by providing generic Risk Band guidelines for the following countries:

|

|

Albania

|

Croatia

|

Italy

|

Netherlands

|

Tajikistan

|

|

Andorra

|

Cyprus

|

Japan

|

New Zealand

|

Turkey

|

|

Armenia

|

Denmark

|

Kazakhstan

|

Norway

|

Turkish Cyprus

|

|

Australia

|

Estonia

|

Kyrgyzstan

|

Portugal

|

Turkmenistan

|

|

Austria

|

Finland

|

Latvia

|

Romania

|

Ukraine

|

|

Azerbaijan

|

France

|

Liechtenstein

|

Russian Federation

|

United Kingdom

|

|

Belgium

|

Georgia

|

Lithuania

|

San Marino

|

United States

|

|

Bosnia And Herzegovina

|

Germany

|

Luxembourg

|

Serbia And Montenegro

|

Uzbekistan

|

|

Bulgaria

|

Gibraltar

|

Macedonia

|

Slovenia

|

Venezuela

|

|

Byelorussia

|

Greece

|

Malta

|

Spain

|

|

|

Canada

|

Iceland

|

Moldova

|

Sweden

|

|

|

Columbia

|

Ireland

|

Monaco

|

Switzerland

|

|

|

D&B's

Risk Bands

|

The predictors of risk used to determine Risk Bands for each country, along with the maximum number of Risk Bands that can be created for each country, are defined

below.

|

|

Country

|

Bands

|

Score(s)

|

|

Albania

|

4

|

D&B Rating®

|

|

Andorra

|

10

|

Failure Risk (Financial Stress) Score (Spain)

|

|

Armenia

|

4

|

D&B Rating®

|

|

Australia

|

10

|

Dynamic Risk Score & Dynamic Delinquency Score

|

|

Austria

|

10

|

Failure Risk Score

|

|

Azerbaijan

|

4

|

D&B Rating®

|

|

Belgium

|

10

|

Failure Risk Score

|

|

Bosnia And Herzegovina

|

4

|

D&B Rating®

|

|

Bulgaria

|

4

|

D&B Rating®

|

|

Byelorussia

|

4

|

D&B Rating®

|

|

Canada

|

10

|

Failure Risk Score & Credit (Delinquency) Score

|

|

Columbia

|

4

|

D&B Rating®

|

|

Croatia

|

4

|

D&B Rating®

|

|

Cyprus

|

4

|

D&B Rating®

|

|

Denmark

|

4

|

Failure Risk Score

|

|

Estonia

|

4

|

D&B Rating®

|

|

Finland

|

4

|

Triple A Rating & D&B PAYDEX® Score

|

|

France

|

10

|

Failure Risk Score

|

|

Georgia

|

4

|

D&B Rating®

|

|

Germany

|

10

|

Failure Risk Score

|

|

Gibraltar

|

4

|

D&B Rating®

|

|

Greece

|

4

|

D&B Rating®

|

|

Iceland

|

4

|

D&B Rating®

|

|

Ireland

|

4

|

D&B Rating®

|

|

Italy

|

10

|

Failure Risk Score & Credit (Delinquency) Score

|

|

Japan

|

10

|

Failure Risk Score

|

|

Kazakhstan

|

4

|

D&B Rating®

|

|

Kyrgyzstan

|

4

|

D&B Rating®

|

|

Latvia

|

4

|

D&B Rating®

|

|

Liechtenstein

|

10

|

Failure Risk Score & Credit (Delinquency) Score

|

|

Lithuania

|

4

|

D&B Rating®

|

|

Luxembourg

|

4

|

D&B Rating®

|

|

Macedonia

|

4

|

D&B Rating®

|

|

Malta

|

4

|

D&B Rating®

|

|

Moldova

|

4

|

D&B Rating®

|

|

Monaco

|

10

|

Failure Risk Score (France)

|

|

Netherlands

|

10

|

Failure Risk Score

|

|

New Zealand

|

10

|

Credit (Delinquency) Score

|

|

Norway

|

4

|

Triple A Rating

|

|

Portugal

|

10

|

Failure Risk Score

|

|

Romania

|

4

|

D&B Rating®

|

|

Russian Federation

|

4

|

D&B Rating®

|

|

San Marino

|

10

|

Failure Risk Score (Italy) & Credit (Delinquency) Score (Italy)

|

|

Serbia And Montenegro

|

4

|

D&B Rating®

|

|

Slovenia

|

4

|

D&B Rating®

|

|

Spain

|

10

|

Failure Risk Score

|

|

Sweden

|

4

|

Triple A Rating & D&B PAYDEX® Score

|

|

Switzerland

|

10

|

Failure Risk Score & Credit (Delinquency) Score

|

|

Tajikistan

|

4

|

D&B Rating®

|

|

Turkey

|

4

|

D&B Rating®

|

|

TURKISH CYPRUS

|

4

|

D&B Rating®

|

|

Turkmenistan

|

4

|

D&B Rating®

|

|

Ukraine

|

4

|

D&B Rating®

|

|

UK

|

10

|

Failure Risk Score & Credit (Delinquency) Score

|

|

US

|

10

|

Failure Risk Score & Credit (Delinquency) Score

|

|

Uzbekistan

|

4

|

D&B Rating®

|

|

Venezuela

|

4

|

D&B Rating®

|

|

Getting Started

|

To view, edit or create a new Risk Band rule, start by going to the Manage Risk Policy: Risk Bands screen by following the steps below:

|

|

Step

|

Action

|

|

1

|

Click on "Manage Risk Policy" on the navigation bar on the left side of your screen. This will bring you to the Manage Risk Policy screen.

|

|

2

|

Click on "Risk Bands". This will bring you to the Manage Risk Policy: Risk Bands screen, where you have three options:

- View a Printable version of a rule

- Edit an existing Risk Band

- Create a new Risk Band

|

|

View/Print Risk Band Rules

|

View and Print existing Risk Band rules by following the steps below.

|

|

Step

|

Action

|

|

1

|

Begin by displaying the rule you want to select from by choosing one of the following display options:

- Most Current

- Last 5 versions

- All versions

|

|

2

|

The appropriate rules will appear in the display box on the right side of the screen.

|

|

3

|

Highlight the rule you would like to view or print in the rule display box.

|

|

4

|

Click on the "View Printable" button.

|

|

5

|

A printable version of the rule you selected will appear.

|

|

US-D&B-UNITED-STATES

Version - 1

Create Date - 12-Oct-01

Created By - D&B

|

| Delinquency |

| Percentile |

| High |

1 |

6 |

| High-Mod |

6 |

19 |

| Moderate |

19 |

57 |

| Low |

57 |

100 |

| Failure Risk |

| Percentile |

| High |

1 |

2 |

| High-Mod |

2 |

5 |

| Low |

5 |

100 |

|

|

Edit Existing Rules

|

Edit an existing Risk Band rule by following the following steps:

|

|

Step

|

Action

|

|

1

|

Begin by displaying the rules you want to select from by choosing one of the following display options:

- Most Current

- Last 5 versions

- All versions

|

|

2

|

The appropriate rules will appear in the display box on the right side of the screen.

|

|

3

|

Select the rule that you want to edit by highlighting it.

|

|

4

|

Click the "Edit" button to bring up the Edit screen, or double click on the rule. A screen will appear with the Risk Scores or other D&B measurements of risk

that were used to define the Risk Bands for the country you selected.

|

|

5

|

The new ranges can be typed in the grid, or adjusted by grabbing the slider tabs for each variable on the X and Y-axis of the graph and moving it until the desired

changes appear in the grid.

|

|

6

|

The example below shows two scores used to define the Risk Bands, the Credit (Delinquency) Score and the Failure Risk Score. On the first tab for the Delinquency Score

the Rates and the Percentiles are displayed. The Rates represent the probability that a customer will pay their bills beyond 90 days. By adjusting the Percentile Limits

for each risk band, the corresponding Rates will adjust accordingly. Once you make changes on the first score, click on the tab for the second score and adjust your

cut offs.

|

|

7

|

Click the "Risk Band Overrides" button to view and/or edit Risk Band Overrides. Instructions for defining Risk Band Overrides are in the Risk Band Override section at

the end of this chapter.

|

|

8

|

When you have finished all of your entries:

- Click the "Save As" button to save your changes with a new rule name. Do not use any punctuation.

- Click the "Save All" button to save your existing rule changes with a new rule version.

- Click the "Reset All" button to reset all of the data and not make any changes.

You cannot edit and create a new version of a D&B default rule. Editing a D&B default rule can only be done by saving as a new rule using the "Save As"

button.

|

|

9

|

If you click "Save As" a pop up screen will appear for you to enter the new rule name. Do not use any punctuation.

|

|

|

|

|

10

|

Your new rule will be added to your list of rule options. If any component of a rule has been updated to a new version, the system will not automatically select the

newest version for a previously defined composite risk policy. The User must explicitly state which versions to use in a new composite rule and designate it as the default

if necessary.

|

|

Creating a New Risk Band Rule – GDM and GDM Plus

|

The Global DecisionMaker application makes it easy for you to create a new Risk Band rule. You can adjust the risk bands according to your tolerance for risk and

name your new Risk Band rule.

When creating new Risk Bands, it is very important to plan to have the number of Risk Bands equal to the number of Risk Bands in the Recommended Limit Matrix. This will

ensure that a limit amount will be defined and match all of the new Risk Bands.

Create a new Risk Band rule by following the steps below:

|

|

Step

|

Action

|

|

1

|

Begin by selecting the country for which you are defining new Risk Bands from the drop down on the Manage Risk Policy: Risk Bands screen.

|

|

2

|

Select the number of risk bands you want from the drop down. You will not be able to select more risk bands than are available for the selected country.

|

|

3

|

Click on the "Create New" button. A screen will appear with the Risk Scores or other D&B measurements of risk that were used to define the Risk Bands for the

country you selected.

|

|

4

|

You can set new ranges by typing them in the grid and hitting the "Enter" key, or by grabbing the slider tabs for each variable on the graph and moving it until the

desired numbers appear in the grid.

|

|

5

|

Once you make changes on the first score, click on the tab for the second score and adjust your ranges.

|

|

6

|

Click the "Risk Band Overrides" button if you want to create an Override. Instructions for creating a Risk Band Override are provided in the next section of this

chapter.

|

|

7

|

When you have finished all of your entries:

- Click the "Save As" button to save your changes with a new rule name. Do not use any punctuation.

- Click the "Reset All" button to reset all of the data and not make any changes.

You cannot edit and create a new version of a D&B default rule. Editing a D&B default rule can only be save as a new rule using the "Save As" button.

|

|

8

|

If you click "Save As" a pop up screen will appear for you to enter the new rule name. Do not use any punctuation.

|

|

9

|

Your new rule will be added to your list of rule options. If any component of a rule has been updated, the system will not automatically select the newest version for a

previously defined composite risk policy. The User must explicitly state which version to use in a new composite rule and designate it as the default if

necessary.

|

|

Creating a New Risk Band Rule – GDM Small Business

|

The Global DecisionMaker application makes it easy for you to create Risk Band rules. When creating new Risk Bands, it is very important to plan to have the

number of Risk Bands equal to the number of Risk Bands in the Recommended Limit Matrix. This will ensure that a limit amount will be defined and match all of the new Risk

Bands.

Create a new Risk Band rule by following the steps below:

|

|

Step

|

Action

|

|

1

|

In the "Country" drop down menu, select "USSB - US Small Business" on the Manage Risk Policy: Risk Bands screen.

|

|

2

|

Select the number of risk bands you want from the drop down. 10 is the maximum number of risk bands available in the U.S., so that is the maximum number of risk bands

you will be able to select.

|

|

3

|

Click on the "Create New" button. A screen will appear with the Small Business Risk Account Score, which is used to define the Risk Bands.

|

|

4

|

The risk Percentiles will be evenly distributed among the risk bands. You can adjust the Percentiles to create new ranges by typing in the grid and hitting the "Enter"

key or by grabbing the slider tabs on the graph and moving them until the desired numbers appear in the grid.

|

|

5

|

Click the "Risk Band Overrides" button if you want to create an Override. Instructions for creating a Risk Band Override are provided in the next section of this

chapter.

|

|

6

|

When you have finished all of your entries:

- Click the "Save As" button to save your changes with a new rule name. A pop up screen will appear for you to enter the new rule name. Do not use any

punctuation. Your new rule name will be prefaced with "US-SB" to denote that it is a Small Business rule.

- Click the "Reset All" button to reset all of the data and not make any changes.

|

|

7

|

Your new rule will be added to your list of rule options. If any component of a rule has been updated, the system will not automatically select the newest version for a

previously defined composite risk policy. The User must explicitly state which version to use in a new composite rule and designate it as the default if

necessary.

|

|

Risk Band Overrides

|

The Risk Band Override component enables you to define criteria to override the risk band rules when your defined conditions are met. Create a new Risk Band

Override rule by following the steps below.

|

|

Step

|

Action

|

|

1

|

Click on the "Risk Band Overrides" button to bring up the Risk Band Overrides screen. If none have been defined, the screen will look like the one

below.

|

|

2

|

Click on the "Add New Override" button to bring up the Risk Band Override criteria builder.

|

|

3

|

In the "Description" field, provide a descriptive name for the new Risk Band Override rule. Do not use any punctuation.

|

|

4

|

Select the first "Data" field that you want to use in your rule from the drop down list.

Note: For Small Business: Commercial data elements are listed first, Consumer elements are listed second, and User-defined custom input data elements are listed

third.

|

|

5

|

Select the "Condition" that you want to use in your rule from the drop down list, e.g., =, >, <, etc.

|

|

6

|

Enter a "Value" for your condition. If using the value of "Null" the operator should be set to "Is".

|

|

7

|

Click the "Add to Condition" button to add your selections to the Condition Box. Repeat process to add new fields.

|

|

8

|

Use the "And Or ( )" buttons to the right to further define your condition statement if necessary, or type them in the box.

- Be sure to use the ( ) to surround logical operations that should be grouped together to ensure correct processing order.

- If you choose to "Add to Condition" and would like to use the Or operator, be sure to remove the And operator.

|

|

9

|

Select a "Decision" from the drop down list.

|

|

10

|

Type in the "Action Message" or click the "Select From List" button to drop down a list of predefined actions to select from.

Note:

- If a variable is used in the Action message, the field content must be enclosed in brackets. i.e., Approve up to [CR_LMT]

- The case of the field content must mirror the case used in the Customer Input Fields. i.e., ALL CAPS or all lower case.

- D&B variables are always in upper case. i.e., [REQ_CR_AMT]

|

|

11

|

Click "Done" to save your new Decision & Action rule.

|

|

12

|

Click "Save" or "Save As" to save your new Recommended Limits Rule. Do not use any punctuation.

Note: You will not be able to use the "Save" command to save a new version of a D&B default rule, you will have to use "Save As" and name your new rule.

|

Back to Table of Contents

Manage Limits, Decisions, & Actions, Section 5

|

Overview

|

The Manage Limits, Decisions & Actions feature provides you with the tools you need to:

- Define your Recommended Limits based on Risk, Industry, and Size segments you establish

- Select a Currency Code

- Apply a Maximum Threshold

- Set Minimum Thresholds

- Define Industry Groups

- Define Decisions an Actions

As with Risk Bands, you can choose the recommended risk limits with pre-populated default limits or you can customize a new matrix according to your Risk Policy

rules.

When creating a U.S. rule, Users can select conservative or aggressive risk limits, based on their overall tolerance for risk.

When creating new Recommended Limits, it is very important to plan to have the number of Risk Bands equal to the number of Risk Bands in the Recommended Limit Matrix.

This will ensure that a limit amount will be defined and match each Risk Band.

|

|

Getting Started

|

Go to the Manage Risk Policy: Recommended Limits screen by following the steps below:

|

|

Step

|

Action

|

|

1

|

Click on "Manage Risk Policy" on the navigation bar on the left side of your screen. This will bring you to the Manage Risk Policy screen.

|

|

2

|

Click on "Manage Limits, Decisions and Actions". This will bring you to the Manage Risk Policy: Recommended Limits screen. There are three options:

- Edit an Existing Rule

- Create a New Rule

- View/Print a rule

|

|

Edit Recom-mended Limits

|

Edit an existing rule by following the steps below:

|

|

Step

|

Action

|

|

1

|

Begin by displaying the rules you want to select from by choosing one of the following display options:

- Most Current

- Last 5 versions

- All versions

The appropriate rules will appear in the display box on the right side of the screen.

|

|

2

|

Select the rule that you want to edit by highlighting it.

|

|

3

|

Click the "Edit" button or double click on the rule to bring up the Edit screen.

|

|

4

|

A matrix with pre-defined limits will appear.

|

|

5

|

There are three views for editing:

- Define Recommended Limits

- Define Industries

- Thresholds

|

|

6

|

Select "Define Recommended Limits" by clicking on the tab. There are four options for editing the Recommended Limits, described below:

|

|

Option

|

Description

|

|

Unit

|

This cannot be changed when editing, the currency code the limits are in will be displayed. Can only be changed when creating new Recommended Limits.

|

|

MAX

|

Change the Maximum Limit by typing it in the MAX box and clicking on the "Apply Max" button. This will adjust Limits in the matrix with the new Maximum Limit

amount. For example, if the new maximum amount entered in the MAX field is 2500, every existing limit in the matrix higher than that will be replaced with 25000.

|

|

Edit/Enter Values

|

Highlight the appropriate cell within the table to change the recommended limit values. Type the value and press the "Enter" key.

Limits must be Internationalized Numeric whole values, without:

- Spaces

- Punctuation

- Symbols

- Special Characters

If not, the cell will be treated as a blank cell in the matrix.

If a variable such as DM_NET_WRTH (DecisionMaker Net Worth) is used in the matrix, brackets should not be used.

|

|

Import Data

|

This function allows you take data from a spreadsheet and drop it into the import data box, which pastes the values into the matrix.

- Click on "Import Data" to bring up the Import screen.

- Highlight the Excel spreadsheet cells and copy them on to your clipboard by using "Control C".

- Paste them into the Import screen by using "Control V".

- Click "Insert" to copy them into the matrix.